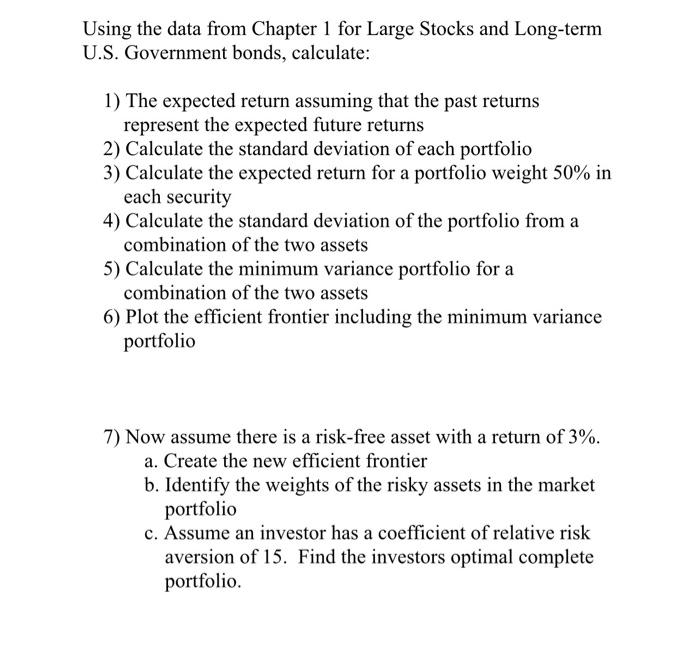

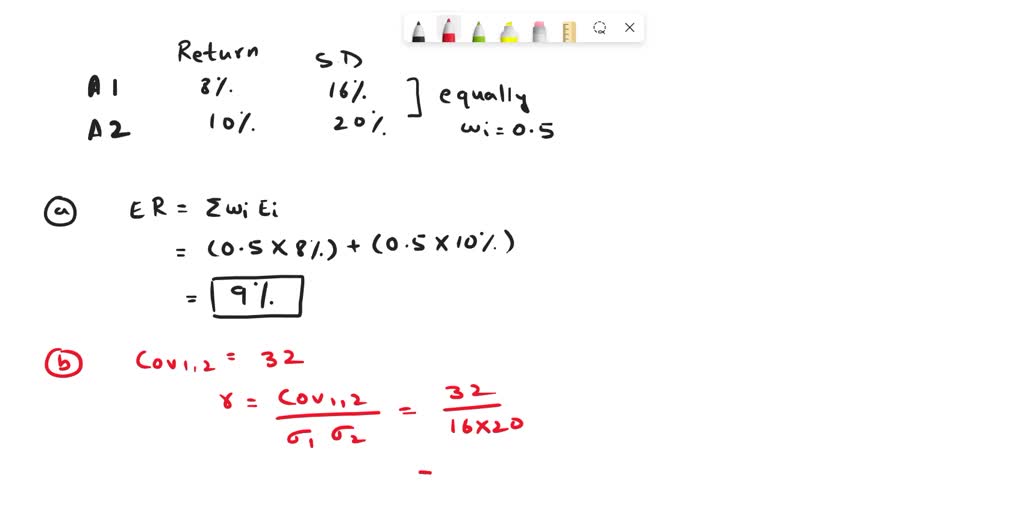

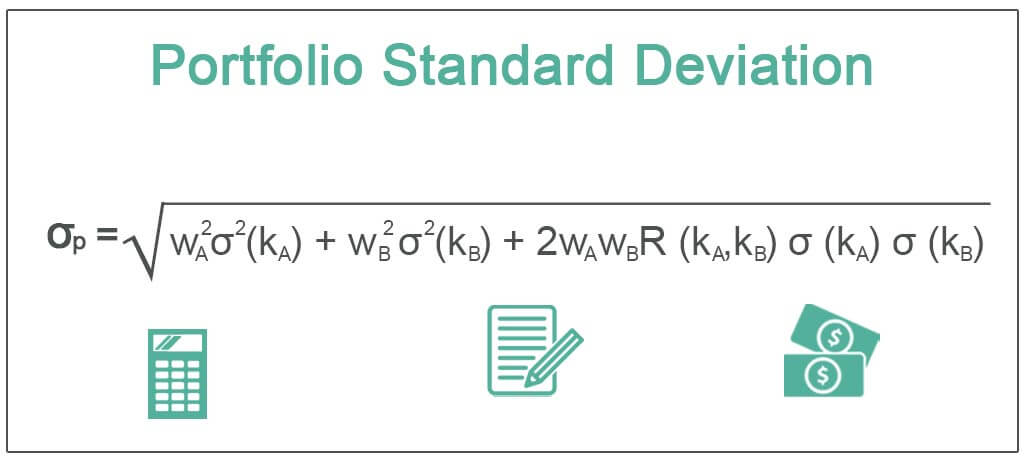

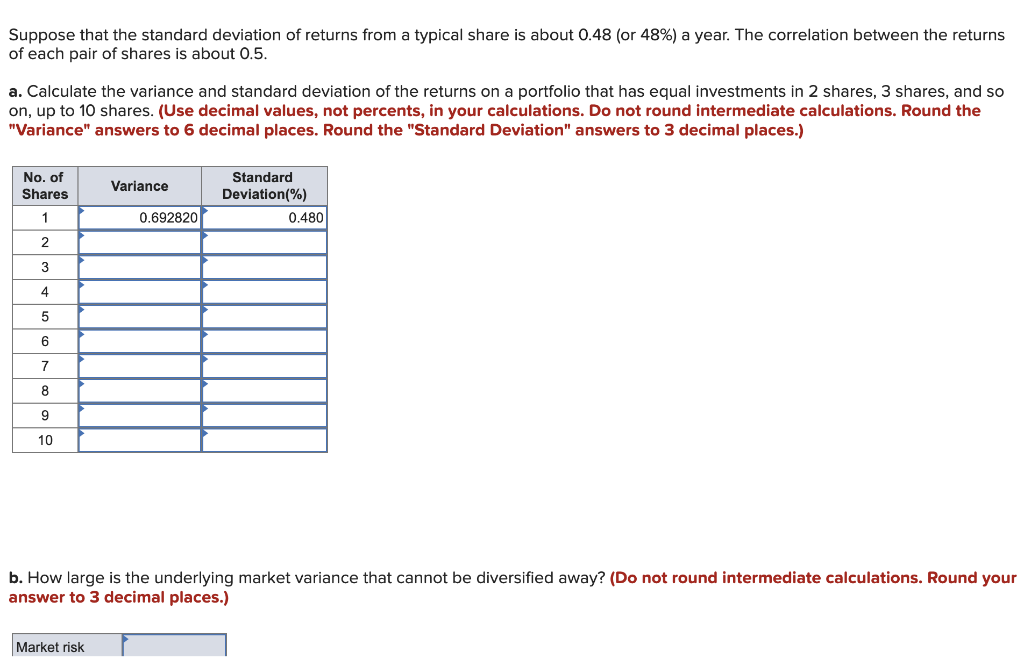

SOLVED: A portfolio consists of two assets, the expected returns and standard deviations of returns of which are listed in the table below; Asset 1 Asset 2 Expected Return 8% 10% Standard

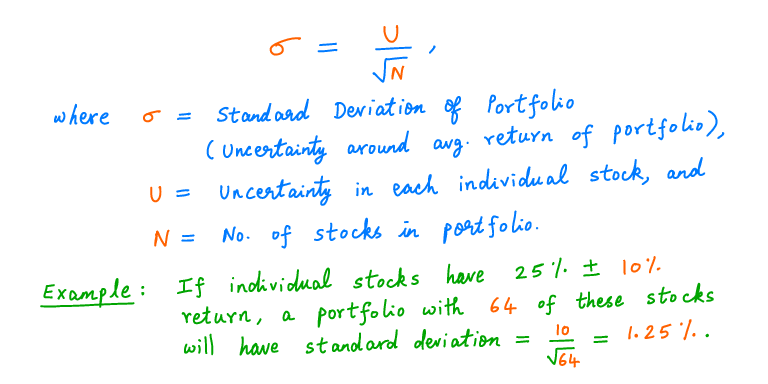

10-K Diver on Twitter: "25/ Here's a formula for the standard deviation of a diversified portfolio with N stocks, given U: https://t.co/erJWvK28F7" / Twitter

:max_bytes(150000):strip_icc()/Standard-Deviation-ADD-SOURCE-e838b9dcfb89406e836ccad58278f4cd.jpg)